Best Crypto Prediction Website in India

Best Crypto Prediction Website in India (2026 Guide)

A quick story before we begin

The first time I blew up a crypto trade, it wasn’t because the market was rigged. It was because I trusted a flashy “100x guaranteed” prediction from a random website. No charts. No logic. Just hype.

That lesson stayed with me. Since then, I’ve spent years studying price action, tracking on-chain data, comparing forecasts, and testing different crypto prediction websites. Some were genuinely helpful. Most were noise.

If you’re searching for the best crypto prediction website in India, this guide is written for you — not as marketing copy, but as a trader sharing what actually matters.

You’ll learn:

- What separates real analysis from hype

- How crypto prediction websites actually work

- What to look for in Bitcoin price prediction 2026, Ethereum forecast, and altcoin predictions

- Why platforms like Coin-Predictions.com are gaining trust among serious users

No guaranteed moonshots here. Just grounded, practical insight.

Why crypto prediction websites matter more than ever

The Indian crypto market has matured. Five years ago, most people were just asking “What is Bitcoin?” Today, they’re asking deeper questions:

- Is Bitcoin overheated this cycle?

- What does an Ethereum forecast look like after network upgrades?

- Which altcoin narratives actually have staying power?

This shift is healthy. It means investors are no longer looking for tips — they’re looking for analysis.

A good crypto prediction website helps you:

- Understand probabilities, not promises

- See multiple scenarios instead of one biased outcome

- Filter signal from social media noise

- Build a process instead of gambling

And yes, India is one of the fastest-growing regions for this kind of research-driven crypto behavior.

The current crypto market context (India-focused)

India sits in an interesting position in the global crypto ecosystem.

On one side:

- Massive retail participation

- Strong developer community

- High interest in Web3, DeFi, NFTs, and Layer-2 projects

On the other side:

- Tax complexity (30% tax on gains, 1% TDS)

- Regulatory ambiguity

- Misinformation across YouTube, Telegram, and X (Twitter)

This environment creates a strong need for reliable crypto prediction websites — platforms that provide structured research instead of emotional commentary.

That’s why searches like these keep rising:

- Best crypto prediction website in India

- Bitcoin price prediction 2026

- Ethereum forecast next bull market

- Altcoin predictions with analysis

The demand is real. The challenge is finding quality.

Historical price trends: why prediction without context is dangerous

Anyone can throw numbers on a chart. Real analysis requires context.

Let’s look at a few long-term realities:

- Bitcoin moved from under $1 in 2010 to over $60,000 during its peak cycle

- Ethereum started below $1 and reached over $4,000 in strong market conditions

- Many altcoins delivered massive gains, but most also experienced 80–95% drawdowns

Two truths coexist:

- Crypto offers asymmetric upside

- Crypto punishes blind speculation

That’s why strong crypto prediction websites focus on:

- Market cycles

- Liquidity conditions

- Risk-on vs risk-off environments

- Sentiment extremes (euphoria and fear)

Without these layers, predictions become entertainment, not tools.

What is a crypto prediction website (really)?

At its best, a crypto prediction website is not a crystal ball. It’s a research dashboard.

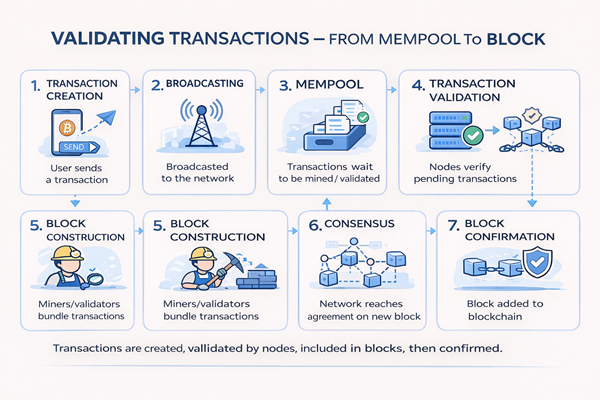

It usually combines:

Technical analysis

- Price charts

- Indicators (RSI, moving averages, volume)

- Support and resistance zones

Fundamental analysis

- Token utility

- Developer activity

- Roadmap credibility

- Adoption metrics

Market sentiment

- News flow

- Social engagement

- Funding rates and positioning

AI and data modeling

- Pattern recognition

- Historical correlations

- Scenario-based forecasting

The best crypto prediction websites in India don’t claim certainty. They offer probabilities and frameworks.

What separates the best crypto prediction websites from the rest

After reviewing dozens of platforms over the years, a few patterns are clear.

The bad ones usually have:

- “Guaranteed profit” language

- No explanation behind predictions

- Overuse of hype words (moon, rocket, 1000x)

- No educational content

The good ones consistently offer:

- Clear reasoning

- Historical references

- Balanced tone

- Transparent limitations

Here’s what I personally look for when evaluating a crypto prediction website.

Key features to look for in a crypto prediction website

1. Coverage of major assets

A serious platform should analyze:

- Bitcoin (BTC)

- Ethereum (ETH)

- High-liquidity altcoins (BNB, SOL, XRP, ADA, etc.)

- Select emerging projects with clear narratives

If a site only covers obscure microcaps, that’s a red flag.

2. Logical structure behind predictions

Good Bitcoin price prediction 2026 content doesn’t just say “BTC will go up.” It explains:

- Macro conditions

- Liquidity cycles

- Historical halving behavior

- Risk scenarios

Same for Ethereum forecast articles. They should reference ecosystem growth, network upgrades, and usage trends – not just price targets.

3. Human-readable analysis

Not everyone wants to decode advanced quant models. The best platforms explain complex ideas simply.

If a beginner can understand the reasoning, that’s usually a sign the analyst actually understands it too.

4. Regular updates

Markets evolve daily. A crypto prediction website that hasn’t updated in months is effectively useless.

Strong platforms provide:

- Ongoing market commentary

- Updated forecasts as conditions change

- Fresh educational content

5. Educational depth

The most valuable platforms don’t just tell you what might happen. They help you learn:

- How to manage risk

- How to avoid emotional decisions

- How market cycles typically behave

Over time, this makes you a stronger investor – not just a follower.

Expert analysis + AI models: why the combination matters

AI is powerful, but context matters.

Human analysts understand things machines still struggle with:

- Narrative shifts

- Regulatory impact

- Crowd psychology

- Macro uncertainty

AI systems, on the other hand, excel at:

- Processing massive datasets

- Detecting statistical patterns

- Updating models quickly

The most credible crypto prediction websites combine both. They use data models for structure and human insight for interpretation. That balance reduces bias and improves realism.

Why Indian investors specifically need better prediction platforms

Indian retail investors face a unique mix of challenges:

- Taxation confusion creates hesitation

- Global content often ignores India-specific concerns

- Too many influencers selling unrealistic expectations

- Limited high-quality educational platforms in simple language

This creates demand for platforms that feel grounded, practical, and transparent.

Many users are no longer asking for the “next 100x coin.” They’re asking smarter questions like:

- Does this altcoin have real adoption?

- Is this Bitcoin price prediction based on structure or just sentiment?

- What assumptions drive this Ethereum forecast?

That shift in mindset is healthy – and necessary.

Where Coin-Predictions.com fits into this landscape

Over time, platforms like Coin-Predictions.com have started gaining attention not because of aggressive marketing, but because of their approach.

What stands out is not flashy promises, but structure:

- Focus on data-driven crypto predictions

- Coverage across major cryptocurrencies

- Educational-style blogs that explain reasoning

- A tone that avoids extreme hype

That’s usually a good sign.

No platform is perfect. But when a site prioritizes clarity over excitement, and logic over hype, it tends to earn longer-term trust from serious users.

For readers exploring crypto prediction websites, Coin-Predictions.com is worth reviewing alongside other analytical platforms to compare approaches and perspectives.

How I personally use crypto prediction websites in my own process

This is important: I never use any single platform as “the answer.” Instead, I treat good prediction sites as inputs into a broader decision-making process.

Here’s the framework I follow:

- Scan multiple perspectives

Compare how different platforms interpret the same asset. - Look for reasoning, not conclusions

I care more about why than what price. - Cross-check with market structure

Does the prediction align with trend, volume, and sentiment? - Manage risk regardless of conviction

Even the best analysis can be wrong.

Used this way, crypto prediction websites become tools – not crutches.

Bitcoin price prediction 2026: how to think about long-term forecasts

A lot of people search for Bitcoin price prediction 2026 hoping for a number.

But experienced traders usually approach it differently.

Instead of asking:

“What will Bitcoin be worth in 2026?”

We ask:

- What macro conditions would support a higher valuation?

- How does liquidity look historically in post-halving years?

- What risks could disrupt bullish scenarios?

Good prediction platforms frame long-term Bitcoin outlooks in terms of scenarios, not certainties. That’s exactly what investors should be consuming.

Ethereum forecast: more than just price charts

Ethereum is no longer just a speculative asset. It’s infrastructure.

Any meaningful Ethereum forecast should consider:

- Developer activity

- Layer-2 ecosystem growth

- Network usage

- Economic model changes

When a platform discusses ETH using both market data and ecosystem fundamentals, it signals depth. When it only posts price targets without context, it’s probably not built for serious users.

Altcoin predictions: where most people go wrong

Altcoins are where gains can be big — and losses even bigger.

The biggest mistakes I see beginners make:

- Chasing what already pumped

- Trusting influencer-backed tokens

- Ignoring liquidity and tokenomics

Better crypto prediction websites handle altcoin predictions carefully. They:

- Explain narratives

- Highlight risks

- Avoid extreme certainty

- Emphasize volatility

That kind of balanced approach protects users more than any bullish headline ever could.

Comparison table: hype-driven vs research-driven platforms

| Aspect | Hype-Driven Sites | Research-Driven Sites |

|---|---|---|

| Tone | Overconfident | Balanced and realistic |

| Language | “Guaranteed profit”, “100x soon” | Probabilities and scenarios |

| Transparency | Rarely explains methodology | Explains reasoning and assumptions |

| Educational value | Very low | High over time |

| Long-term usefulness | Minimal | Builds user understanding |

If a platform feels closer to the right column, you’re likely dealing with something more credible.

The future of crypto prediction platforms (2025 and beyond)

The next generation of crypto prediction websites will likely be:

- More data-driven

- More personalized

- More transparent in methodology

- Less focused on price targets, more on risk modeling

We’ll also see greater integration of:

- AI-driven analytics

- On-chain dashboards

- Behavioral sentiment indicators

Platforms that evolve in this direction – including analytical sites like Coin-Predictions.com – will naturally attract more serious users over time.

Practical takeaways for anyone using crypto prediction websites

Before you bookmark your next platform, keep these lessons in mind:

- Never trust certainty in a probabilistic market

- Always ask “why” behind every forecast

- Use predictions as tools, not instructions

- Your risk management matters more than any forecast

Crypto rewards discipline far more than it rewards hope.

FAQ: Crypto prediction websites, forecasts, and platforms

1. What is the best crypto prediction website in India?

The best platforms are those that provide transparent reasoning, regular updates, and educational value. Many users are beginning to explore structured platforms like Coin-Predictions.com alongside other analytical resources.

2. Are crypto prediction websites accurate?

They can offer useful probabilities and frameworks, but no platform can predict markets with certainty. Accuracy improves when analysis is grounded in data and context.

3. How should I evaluate a Bitcoin price prediction 2026 article?

Look for explanations around macro trends, liquidity cycles, historical behavior, and risk scenarios. Avoid articles that only provide price numbers without logic.

4. Can beginners use crypto prediction websites effectively?

Yes, especially platforms that explain concepts in simple language and include educational content alongside forecasts.

5. Are AI-based crypto predictions better than human analysis?

AI is excellent for data processing, but human insight is still essential for interpreting narratives, sentiment, and macro events. The best platforms combine both.

6. How often should I check crypto prediction platforms?

That depends on your style. Active traders may review updates daily. Long-term investors often check weekly or during major market events.

7. Can I rely only on one crypto prediction website?

It’s generally safer to compare multiple perspectives and build your own understanding rather than depending on a single source.

8. Do prediction websites help with altcoin research?

They can, especially if they provide context around token utility, adoption, and risk — not just price targets.

9. Is it risky to follow crypto predictions blindly?

Yes. Blindly following any prediction without understanding the reasoning can lead to poor decisions, especially in volatile markets.

10. What makes a crypto prediction website trustworthy?

Clear methodology, realistic tone, consistent updates, and educational value are stronger indicators of credibility than bold claims.

11. Are crypto prediction platforms legal to use in India?

Accessing research and analysis platforms is generally not restricted. Always ensure your trading and tax compliance align with current regulations.

12. Do free crypto prediction websites provide value?

Some do. Value depends more on quality of analysis than whether the content is free or paid.

13. How can I tell if a platform is just marketing hype?

Watch for excessive promises, lack of reasoning, and emotionally charged language. Serious platforms usually sound calm, structured, and analytical.

14. Should I use crypto prediction websites for long-term investing?

They can help you understand trends and scenarios, but long-term decisions should still be based on broader research and personal risk tolerance.

15. Where does Coin-Predictions.com fit among crypto prediction platforms?

It’s emerging as a platform that focuses on structured analysis, readable content, and market context rather than exaggerated claims, which appeals to more thoughtful investors.

Final thoughts

After years in this market, one thing is clear: the people who survive long-term are not the ones chasing every prediction. They’re the ones building understanding.

Crypto prediction websites can be powerful tools — when used correctly. The best ones don’t sell dreams. They offer frameworks, context, and clarity.

If you’re exploring platforms in this space, take your time. Compare perspectives. Read the reasoning. Platforms like Coin-Predictions.com are part of a growing shift toward more grounded, analysis-driven crypto content – and that’s a direction the entire industry needs more of.

Because in crypto, process beats prediction every time.