Eliminating the Middleman – Decentralization Explained

Intent: Explain decentralization and its business/user experience implications when removing trusted intermediaries.

Introduction – The Power of Decentralization

Every time you pay online, sign a contract, or send money, there’s usually a middleman — a bank, a broker, a platform, or a notary ensuring things go smoothly and securely.

But what happens when technology lets us trust the system itself, not the intermediary?

That’s the promise of decentralization, one of blockchain’s most revolutionary ideas. In this lesson, we’ll explore what decentralization means, how it works, and why eliminating middlemen can transform not only technology – but entire business models and user experiences.

What Does “Decentralization” Really Mean?

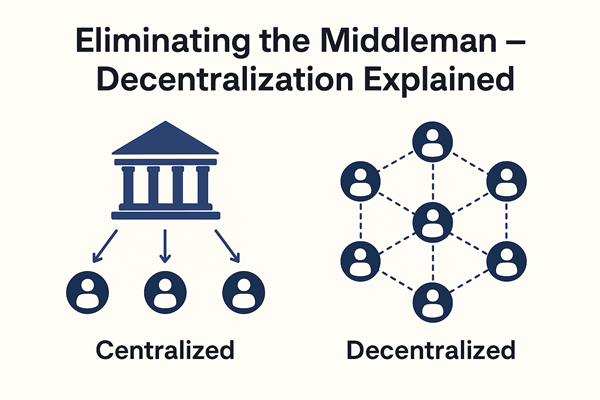

At its core, decentralization means distributing control and decision-making away from a single authority to many independent participants.

In a centralized system, a single entity (like a bank or company) manages data, validates transactions, and enforces rules.

In a decentralized system, those responsibilities are shared across a network of computers (called nodes). Each node maintains a copy of the ledger and validates activity using agreed-upon protocols.

Think of it like this:

- In centralized banking, your transactions depend on the bank’s servers.

- In decentralized finance (DeFi), your transactions are verified by thousands of independent nodes across the world – no single point of control or failure.

Why Middlemen Exist in the First Place

Middlemen weren’t created to slow things down – they exist because trust is expensive.

In traditional systems:

- Banks verify transactions to prevent fraud.

- Platforms mediate trades to ensure fairness.

- Payment processors secure your money transfers.

They add trust, but they also add cost, friction, and dependency. When you depend on a single middleman, you rely on their rules, uptime, fees, and sometimes, their permission to access your own data or funds.

How Blockchain Removes the Middleman

Blockchain replaces human or corporate intermediaries with mathematical trust — rules encoded directly into software.

Here’s how:

- Consensus Mechanisms – Instead of one authority verifying data, all participants must agree on the validity of transactions. (E.g., Proof-of-Work or Proof-of-Stake.)

- Cryptographic Security – Every transaction is secured with encryption, making unauthorized changes virtually impossible.

- Smart Contracts – These are self-executing agreements that trigger automatically when certain conditions are met — no lawyers or brokers required.

Example:

A decentralized marketplace built on blockchain lets buyers and sellers transact directly. Smart contracts hold payments in escrow until goods are received, eliminating the need for a platform like eBay or Amazon to mediate.

Business Implications – The New Model of Trust

Decentralization is changing how companies build and capture value.

- Disintermediation: Businesses that once thrived on being middlemen (banks, travel agencies, brokers) must now find new roles — offering expertise, user experience, or added security on top of open systems.

- Open Ecosystems: Instead of proprietary databases, decentralized businesses share infrastructure with others — creating network effects and global interoperability.

- New Revenue Models: Tokens, transaction fees, or staking replace traditional commissions.

For startups, this means lower entry barriers. For incumbents, it means reinvent or risk being replaced by community-driven protocols.

User Experience Implications -Freedom with Responsibility

For users, decentralization promises more control and privacy, but also more responsibility.

Pros:

- Full ownership of data and assets

- No censorship or arbitrary restrictions

- Lower fees and global access

Cons:

- You’re responsible for your keys (lose them, lose your funds)

- No “forgot password” support

- Slower user experience (in some blockchains) due to consensus

UX designers now face the challenge of balancing freedom with usability — creating wallets, dApps, and interfaces that are as simple as Web2 but powered by Web3.

Real-World Examples of Decentralization

- Finance (DeFi): Platforms like Uniswap and Aave let users lend, borrow, or trade crypto without a bank.

- Content (Web3 Media): Platforms like Mirror.xyz or Audius let creators publish and earn directly from their audience.

- Identity (SSI): Self-sovereign identity systems let people own their digital credentials without relying on Google or Facebook logins.

- Cloud Storage: Projects like Filecoin or Arweave decentralize data storage, rewarding users for providing space.

Each example removes a traditional intermediary — and shifts power to the edges of the network.

Challenges & Trade-Offs

Decentralization isn’t a silver bullet. It brings complexity, coordination issues, and scalability limits.

- Performance: Consensus takes time — slower than centralized databases.

- Governance: Who decides protocol updates? Communities often struggle to align.

- Security Risks: While blockchains are secure, smart contract bugs can lead to major losses.

That’s why hybrid models (combining decentralization with selective central control) are becoming popular — offering the best of both worlds.

The Human Impact – More Than Just Technology

Removing middlemen isn’t just about code — it’s about reshaping relationships.

- Users become stakeholders, not customers.

- Communities govern networks instead of companies.

- Transparency replaces blind trust.

Blockchain decentralization marks a shift from trusting institutions → to trusting math and code → and ultimately → trusting communities.

Conclusion – The Future Is Distributed

Decentralization is not anti-centralization — it’s about choice. It gives individuals, developers, and businesses the option to participate in systems that don’t rely on a single authority.

In the coming years, decentralized systems will quietly power finance, healthcare, supply chains, and digital identity. The middleman won’t disappear — but they’ll evolve into value-added collaborators, not gatekeepers.

Next Lesson Preview

Lesson 4: The Block – How Data Becomes Tamper-Proof

We’ll zoom in on how blockchain actually packages transactions into “blocks” and links them securely using cryptography.